Stock screeners are a really helpful tool, and using the right one can make researching investments a breeze.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

You shouldn’t pick stocks for your portfolio based on a hot tip you got from a friend or from a TikTok video. Selecting stocks takes some consideration; it’s best not to do it on a whim. Free stock screeners can help you make informed decisions when it comes to adding investments to your portfolio.

Free stock screeners

Cheap is good, but free may be better. Here are some of the best free stock screeners available. Most don’t require creating an account, though some, like Morningstar and Finviz, do.

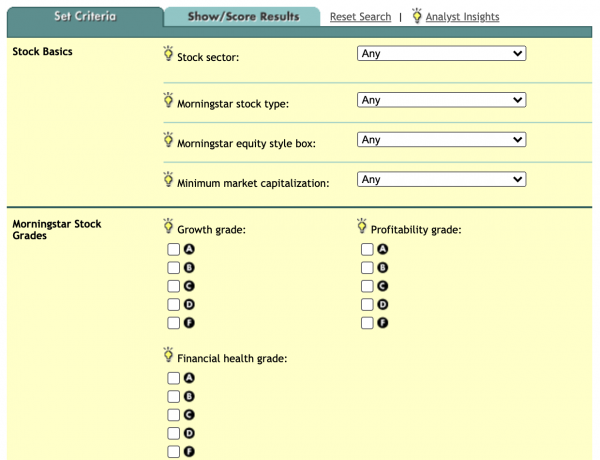

1. Morningstar

Morningstar’s basic stock screener offers a clean (if somewhat dated-looking) interface with helpful tooltip windows that explain each filter. Morningstar is a research firm, and the Morningstar Stock Grades are included in the basic filter. This gives investors easy access to Morningstar’s expert analysis within the screener. Morningstar also has screeners for exchange-traded funds and mutual funds. The tool itself is somewhat limited, but Morningstar does offer a Premium option for those who want to dive deeper into their searches.

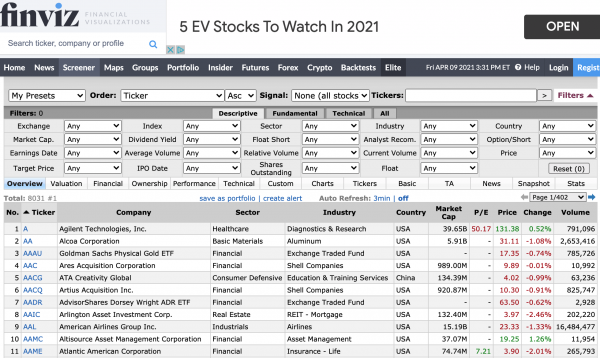

2. Finviz

Finviz is often included in roundups of the best stock screeners, and for good reason. Finviz’s user interface may feel a little crowded at first glance, but once your eyes adjust it’s easy to find all the filters you need without clicking through additional pop-up pages or screens. Finviz can filter some data that’s hard to find on other screeners, such as IPO date and outstanding shares. It also allows users to save preset screens, making it easy to come back to a filtered search you’ve already saved. You’ll only be able to use that functionality if you create an account on the site, which is free.

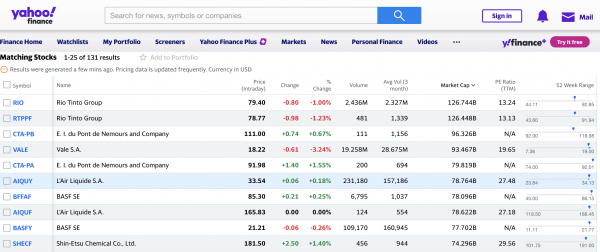

3. Yahoo Finance

Yahoo Finance’s stock screener is a great free tool that combines a clean user interface with a wide variety of filters. This screener is one of the few free resources that allows you to screen for sustainable ESG (or environmental, social and governance) stocks. It also gives users access to screeners for mutual funds, ETFs and futures.

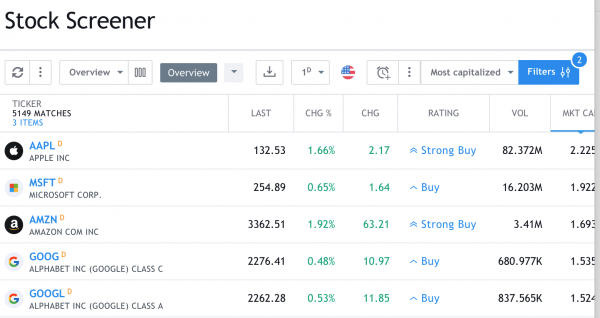

4. TradingView

TradingView’s stock screener is aptly named: It has one of the friendlier user interfaces and a clean appearance. This may be a good pick for beginners who don’t want to be overwhelmed by too much information (though more advanced day traders will still find a plethora of technical data to sift through). TradingView also has forex (or foreign exchange) and cryptocurrency screeners.

5. StockFetcher

If you’re looking for a powerful stock screener, StockFetcher may be the one for you. StockFetcher supports more than 125 indicators from which users can build unique stock filters. The amount of data StockFetcher uses may feel overwhelming, but the site has a convenient User Guide front and center to help orient you. There are also several example filters if you need some inspiration before you create your own.

Free stock screeners from brokers

While most online brokers likely won’t charge you to use their stock screeners, you may need to have an account with them before you can use their tools at full capacity. If you have a brokerage account, you may have access to a stock screener already. If you don’t, stock screeners may be an important factor to consider when deciding where to open one.

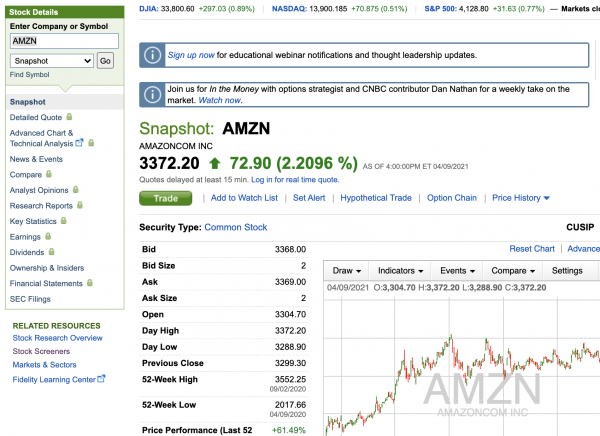

6. Fidelity

While you can look up individual stocks using Fidelity’s screener without an account, you’ll need one to access more advanced features. Without an account, you can see a stock’s snapshot, which includes things like its bid and ask prices, its 52-week high and a chart of performance data. If you have an account, you get access to additional features such as investing themes, which lets you view stocks in categories such as drones, natural foods and wind energy, and more detailed stock quotes and analyst opinions.

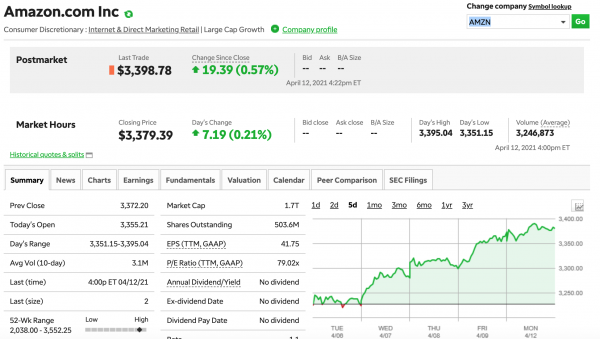

7. TD Ameritrade

Like Fidelity, TD Ameritrade lets nonregistered users have access only to stock snapshots. These snapshots are helpful if you just want basic information about a stock, but you can’t see anything more advanced than that. If you have a TD Ameritrade account, the Stock Hacker tool lets you find stocks using your own criteria and gain access to TD’s third-party analyst research and ratings.